By God’s grace, I did pass my Level I exam in June 2014. That was basically my attitude as I burrowed through my exam prep with toil and stress. No matter how bleak it seems, at least sit for the exam and treat it as a learning experience. My mind simply could not keep up after a hard day at work.ĭoes all these sound familiar to you? Well, take heart. I can still recall the number of times I dozed off while studying, or just going back and forth trying to understand even the simplest concept. Having no background in finance at all, I tried very hard to read the curriculum from cover to cover, but eventually that fell flat. To compound my problems, I basically did not have a preparation strategy.

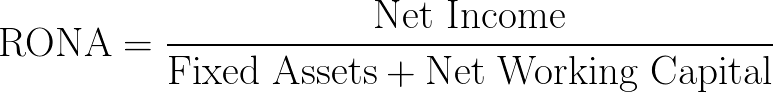

It was not until the middle of March 2014 that I realized I only had a little more than 2 months to the exam. I naturally neglected the preparation for my Level I exam in June 2014. Was it tough? You bet!Īdjusting to the drastic career change was tough. Having developed a keen interest in finance, I decided on a career switch to the finance field and enrolled into the CFA program at the same time. I am a Computer Engineering graduate and have been working as an engineer all my life. Investors would have to compare Charlie’s return with other construction companies in his industry to get a true understanding of how well Charlie is managing his assets.Are you a CFA Level I candidate, or someone who is exploring taking the CFA exam? Four years ago, I was in your shoes. Depending on the economy, this can be a healthy return rate no matter what the investment is. In other words, every dollar that Charlie invested in assets during the year produced $13.3 of net income. Charlie’s return on assets ratio looks like this.Īs you can see, Charlie’s ratio is 1,333.3 percent. During the current year, Charlie’s company had net income of $20,000,000. Charlie’s balance sheet shows beginning assets of $1,000,000 and an ending balance of $2,000,000 of assets.

#Return on assets software#

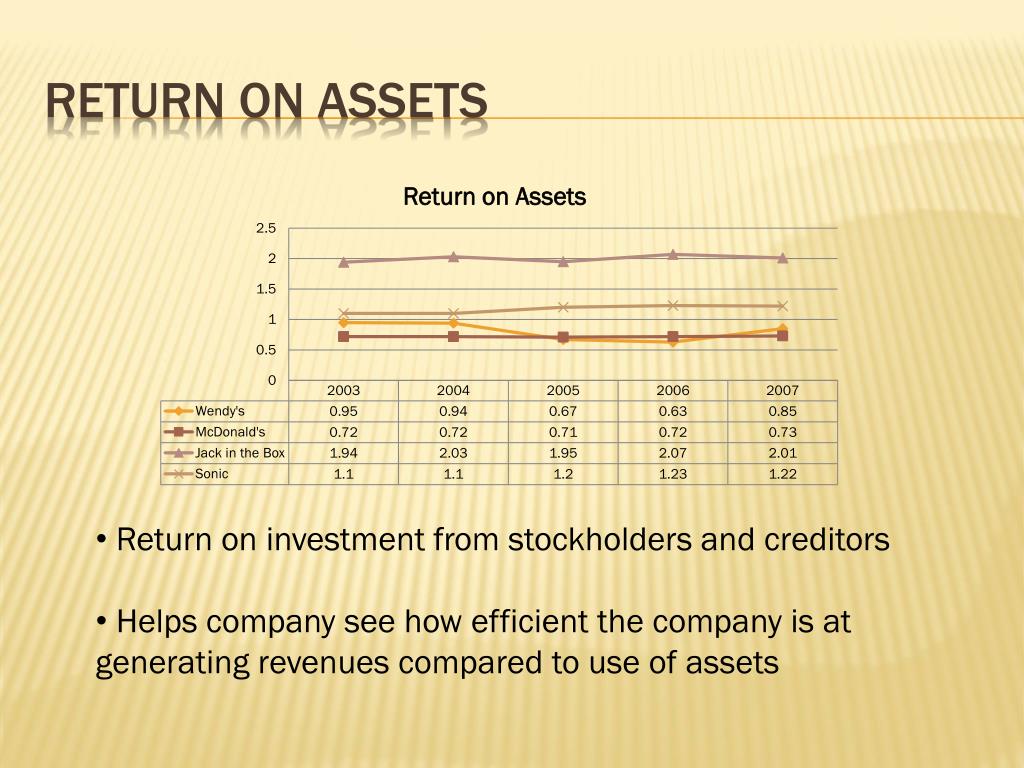

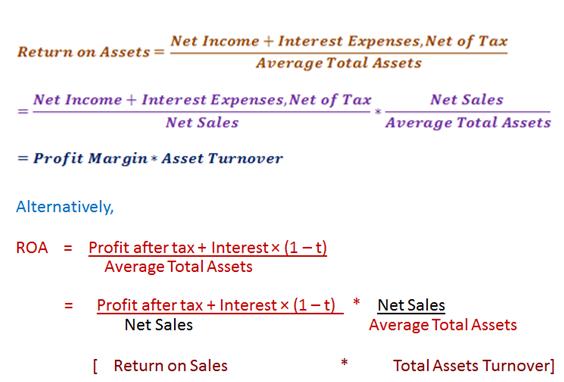

For instance, construction companies use large, expensive equipment while software companies use computers and servers.Ĭharlie’s Construction Company is a growing construction business that has a few contracts to build storefronts in downtown Chicago. ROA is most useful for comparing companies in the same industry as different industries use assets differently. A positive ROA ratio usually indicates an upward profit trend as well. It only makes sense that a higher ratio is more favorable to investors because it shows that the company is more effectively managing its assets to produce greater amounts of net income. Since all assets are either funded by equity or debt, some investors try to disregard the costs of acquiring the assets in the return calculation by adding back interest expense in the formula. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. The return on assets ratio measures how effectively a company can earn a return on its investment in assets. The net income can be found on the income statement. It might be obvious, but it is important to mention that average total assets is the historical cost of the assets on the balance sheet without taking into consideration the accumulated depreciation. Simply add the beginning and ending assets together on the balance sheet and divide by two to calculate the average assets for the year.

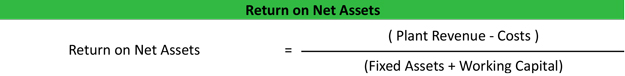

When using the first formula, average total assets are usually used because asset totals can vary throughout the year. This ratio can also be represented as a product of the profit margin and the total asset turnover.Įither formula can be used to calculate the return on total assets.

0 kommentar(er)

0 kommentar(er)